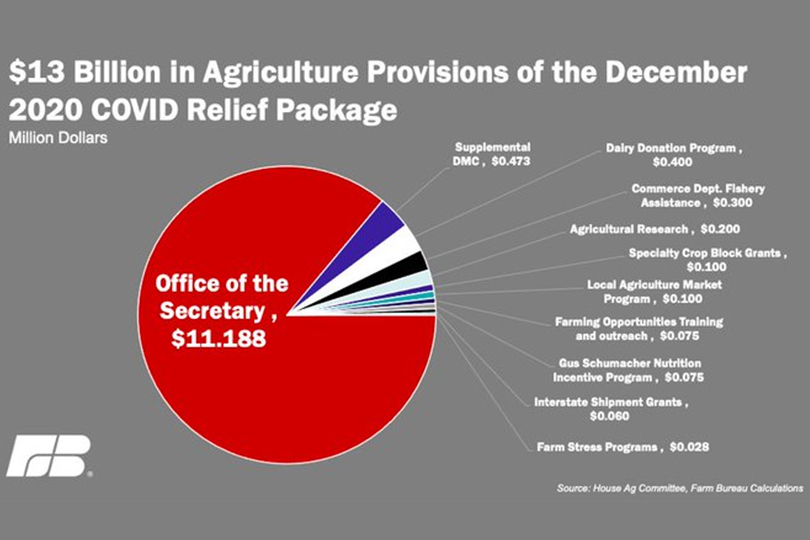

Congress agreed on a $900 billion COVID stimulus package late Monday night. The package includes up to $13 billion earmarked for agriculture.

“Texas Farm Bureau (TFB) is pleased Congress has acted to provide roughly $13 billion in additional direct assistance to farmers and ranchers who continue to struggle with uncertainty caused by COVID-19,” TFB President Russell Boening said.

The bi-partisan bill includes $900 billion in coronavirus relief and $1.4 trillion in fiscal spending.

With the COVID relief package, many farmers and ranchers who were previously left out of aid will now qualify, as well as those who have received assistance through the U.S. Department of Agriculture (USDA) in government programs earlier this year.

“Supplemental assistance will be provided for farmers with crops included under the USDA Coronavirus Food Assistance Program to help with the many challenges they have faced this year. Additional support is secured for cattle ranchers who have experienced extreme market volatility due to the pandemic,” Boening said. “The legislation creates a livestock dealer trust to protect ranchers from dealer payment default, which provides additional coverage for ranchers during the uncertainty of COVID-19 and moving forward.”

Dairy farmers will also see more support provided through Dairy Margin Coverage and other dairy donation programs. Provisions are included in the bill to address supply chain issues and to provide assistance for livestock and poultry contract growers.

TFB and the American Farm Bureau Federation worked to ensure the needs of farmers and ranchers were considered during the latest stimulus package negotiations.

Highlights of the coronavirus stimulus bill include:

- 80 percent reimbursement for losses due to premature euthanization or canceled orders

- $20 per planted acre for non-specialty crops.

- Crop insurance payments and disaster payments may be used to calculate 2019 sales.

- $7 billion is allocated for broadband, including $300 million for rural broadband and $250 million for telehealth.

- Paycheck Protection Program funding may be used for COVID mitigation expenses.

- Expenses paid with Paycheck Protection Program loans will now be allowed as a tax deduction

- 15% increase in SNAP benefits.

“We thank the many Congressional leaders in Washington who worked diligently to provide meaningful end-of-year support to Texas’ farm and ranch families. We look forward to our continued work in the new year,” Boening said.

In addition the pandemic-related provisions, the omnibus included critical funding for other agriculture-related needs, such as funding to combat cattle fever ticks and feral swine.

“It also includes an anomaly to fully fund the commitments made to farmers under the Wildfires and Hurricane Indemnity Program Plus (WHIP+) for both 2018 and 2019 crop years,” Boening said. “Texas Farm Bureau will continue working with leaders of Congress and other states to provide an extension of WHIP+ for the 2020 crop year.”

Read more about the COVID-19 relief package for agriculture in this Market Intel report.