By Jennifer Whitlock

Field Editor

Recent severe weather events and the increased threat of severe storms in spring have many Texans upgrading or replenishing their emergency supply kits.

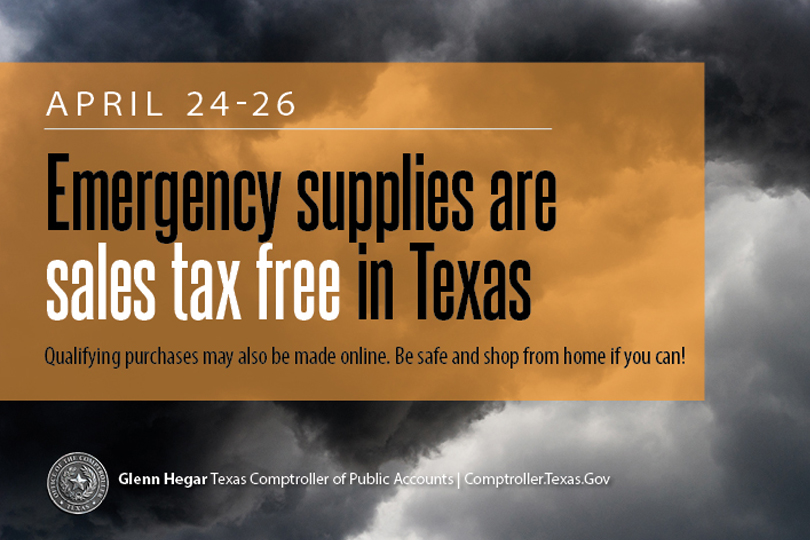

The upcoming 2021 Emergency Preparation Supplies Sales Tax Holiday, which begins at 12:01 a.m. on April 24 and ends at midnight on April 26, is an ideal opportunity to do so while saving money, said Texas Comptroller Glenn Hegar.

“While we can’t know when the next flood, tornado or hurricane may strike, we can make sure our families, homes and businesses have the supplies they need to face these and other emergencies,” Hegar said. “This tax holiday can help Texans save money while stocking up for emergency situations.”

The Comptroller’s office estimates shoppers will save more than $1.8 million in state and local sales taxes during the tax holiday, which was approved by the Texas Legislature in 2015.

Qualifying emergency supplies include items such as:

Less than $3,000

- Portable generators

Less than $300

- Emergency ladders

- Hurricane shutters

Less than $75

- Axes

- Batteries, single or multipack (AAA cell, AA cell, C cell, D cell, 6 volt or 9 volt)

- Can openers – nonelectric

- Carbon monoxide detectors

- Coolers and ice chests for food storage – nonelectric

- Fire extinguishers

- First aid kits

- Fuel containers

- Ground anchor systems and tie-down kits

- Hatchets

- Ice products – reusable and artificial

- Light sources – portable self-powered (including battery operated, candles, flashlights and lanterns)

- Mobile telephone batteries and mobile telephone chargers

- Radios – portable self-powered (including battery operated) – includes two-way and weather band radios

- Smoke detectors

- Tarps and other plastic sheeting

There is no limit on the number of qualifying items purchased and an exemption certificate is not necessary. Purchases do not have to be made in-store to qualify.

Purchases made online or by telephone, mail, custom order or any other means than in-person qualify for sales tax exemption when either:

- The item is paid for by and delivered to the customer during the tax holiday; or

- The customer orders and pays for the item and the seller accepts the order during the tax holiday for immediate shipment, even if the delivery occurs after the holiday has ended.

For online purchase, the Comptroller’s office noted delivery, shipping, handling and transportation charges are considered part of the sales price. If the emergency preparation supply being purchased is taxable, the delivery charge is also taxable.

Hegar advised Texans to take this into consideration when determining whether an emergency preparation supply can be purchased tax-free during the holiday.

Several over-the-counter self-care items—such as antibacterial hand sanitizer, soap, spray and wipes— are always exempt from sales tax if they are labeled with a “Drug Facts” panel in accordance with U.S. Food and Drug Administration (FDA) regulations.

Household items that do not qualify for tax exemption even though they may be used during an emergency include medical masks or face masks; cleaning supplies; gloves; toilet paper; batteries for automobiles, boats and other motorized vehicles; camp stoves; chainsaws; plywood; extension ladders; stepladders; and tents.

More information on the sales tax holiday is available on the Comptroller’s website.

I live in Austin Texas and went to a Walmart on those days and was charged tax fir all the necessary items that were to be tax free. I asked the manager and he stated he knew nothing about any tax free weekend abs if that was so it would automatically be on their system

Hi, Gina. You could reach out to the Comptroller’s office about that since the sales tax holiday is something the Comptroller announced. https://comptroller.texas.gov/about/contact/