By Jessica Domel

Multimedia Report

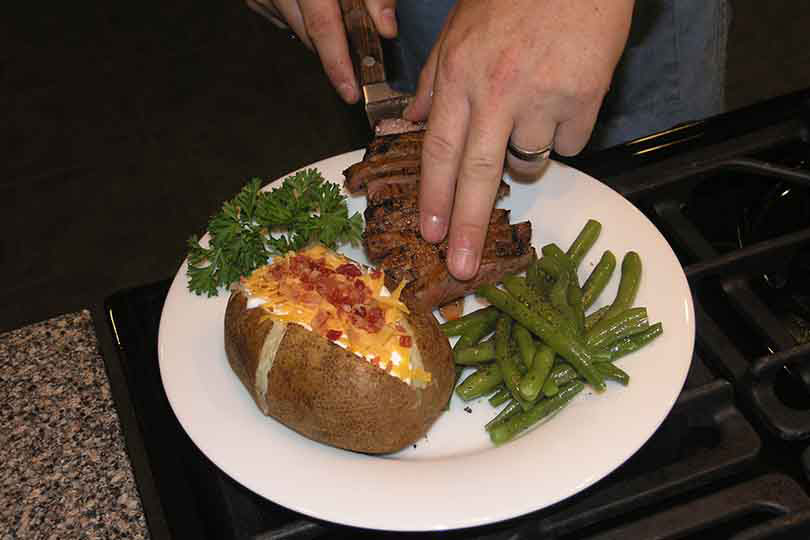

The world is eating more meat. And American livestock producers are increasing their production to ensure families get just what they want.

Beef

Countries across the globe continue to purchase American beef for its quality and taste

In June 2017, China re-opened its market to American beef for the first time in 14 years. Since then, about $23 million in beef has been exported to the country.

Japan, South Korea, Columbia, Peru and South Africa also import U.S. beef, according to the U.S. Meat Export Federation.

To keep up with that demand, beef production has increased.

During the last quarter in 2017, the most recent data, red meat production was up three percent from the same time in 2016.

“For the month of November, beef production showed the highest year-over-year growth at two percent,” Katelyn McCullock, economist with the American Farm Bureau Federation, said.

The last Cattle on Feed report for 2017 held some surprises for analysts. The report beat the average estimates by about nine percent in terms of placements.

“Placements were up 14 percent compared to a year ago,” McCullock said. “The number of cattle on feed was also significantly higher than expected, which was nine percent. Marketing continued to remain strong up three percent, which is actually the highest marketings, I think, for the month of November since the Cattle on Feed report started.”

Nationally, there was an increase in the number of light calves placed in feedlots at the end of 2017 due in part to higher prices being paid for lighter cattle.

“Those numbers climbed 30 percent from a year ago for calves under 600 pounds,” McCullock said. “Texas amplified that national trend in about 70 percent higher in calves under 600 pounds compared to last year. It was 36 percent higher in the 600-700 pound category.”

Lighter calves mean cattle have to be on feed longer. It also offers feedlots some flexibility in marketing.

Red meat inventory was down four percent at the end of 2017. Beef inventory was down eight percent, which McCullock said is a good sign considering the heavy supply produced all year.

Pork

The U.S. Department of Agriculture’s (USDA) National Agricultural Statistics Service (NASS) includes pork in its numbers for red meat.

Demand is expected to stay strong.

“For beef and pork levels, it is expected to continue to remain on an expansionary type track,” McCullock said. “Hogs and pigs showed a continued increase in the number of sows being farrowed, as well as those kept for breeding.”

The Hogs and Pigs report showed the continued trajectory of growing more hogs for market.

“Both market hogs increased, farrowing increased and those hogs kept for breeding were also up,” McCullock said. “Those numbers really point to an increase in continued greater number of hogs coming for market, as well as increased pork production.”

The number of hogs kept for breeding were up one percent. The sows expected to farrow between December and May is up 2.5 percent.

“That looks like producers are continuing to expect good pork demand both on the domestic front and probably on the export front,” McCullock said. “The expectations are good to have another year of fairly good margins.”

Feed costs continue to be low, and pork prices have remained relatively strong.

“In pork, we see a continued strength growing in middle class throughout the globe, which will continue to support the increase in demand for red meat,” McCullock said. “As those populations get a little bit more income, they like to eat a little bit better. That’s usually where we see a lot of increase for export demand.”

Pork inventory was down three percent in the last quarter of 2017.

Lamb

Lamb, like pork and beef, showed year-over-year growth.

Unlike the other two meats, lamb inventory was down. Weights were slightly higher in November 2017 and about one pound heavier than last year.

Lamb is also included in red meat production numbers from NASS.

Poultry

Poultry stocks are up 15 percent compared to one year ago. Chicken showed an increase of 13 percent. Turkey stocks grew 22 percent.

“From a competitive meat standpoint, we’re expecting growth in both broilers and turkeys f

What about goats?

In December of 2017, there were 488,800 head of goats federally inspected for slaughter. That is 40,0000 higher than 2016. That information is from a report released Jan. 25, 2018: http://usda.mannlib.cornell.edu/usda/current/LiveSlau/LiveSlau-01-25-2018.pdf.