By Jessica Domel

Multimedia Reporter

The U.S. Department of Agriculture (USDA) raised its forecast for 2025 net farm income on higher livestock receipts and increased direct government payments offsetting increased production costs.

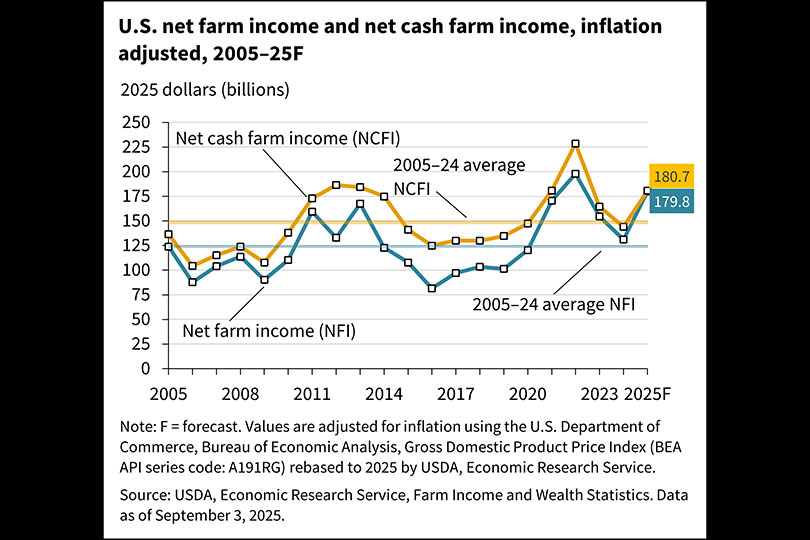

USDA’s Economic Research Service (ERS) forecasts net farm income, a broad measure of profits, for calendar year 2025 at $179.8 billion, up 40.7% or $52 billion, not adjusted for inflation, over 2024.

Adjusted for inflation, that’s an increase of 37.2% or $48.8 billion.

“Driving the forecast increase are commodity cash receipts or cash sales, which are forecast to increase $24 billion or almost 5%,” Carrie Litkowski, USDA ERS senior economist, said in a webinar on the forecast. “This is entirely from animal and animal products. Also, direct government payments are forecast at $40.5 billion, an increase of $30 billion from 2024.”

Net cash farm income, which includes cash receipts from farming and cash-farm related income, including government payments, minus cash expenses, is forecast at $180.7 billion for calendar year 2025.

That’s up 28.5% or $40.1 billion over 2024, not adjusted for inflation. When adjusted for inflation, that’s an increase of 25.3% or $36.5 billion.

Both net cash farm income and net farm income forecasts, if realized, would be above their respective 20-year averages.

Average net cash farm income for farm businesses is forecast to rise 12% this year to $127,000 per farm in 2025, not adjusted for inflation.

Farm businesses are classified as those that have an annual gross cash farm income (GCFI) of at least $350,000 or operations with less than $350,000 in GCFI but report farming as the operator’s primary occupation.

“These farm businesses account for over 90% of the total value of agricultural production in the U.S.,” Litkowski said.

In its forecast, ERS noted eight of the nine ERS Farm Resource Regions are expected to see average net cash farm income rise in 2025. Farms that specialize in animals and animal products are forecast to see higher net cash farm income.

Livestock receipts

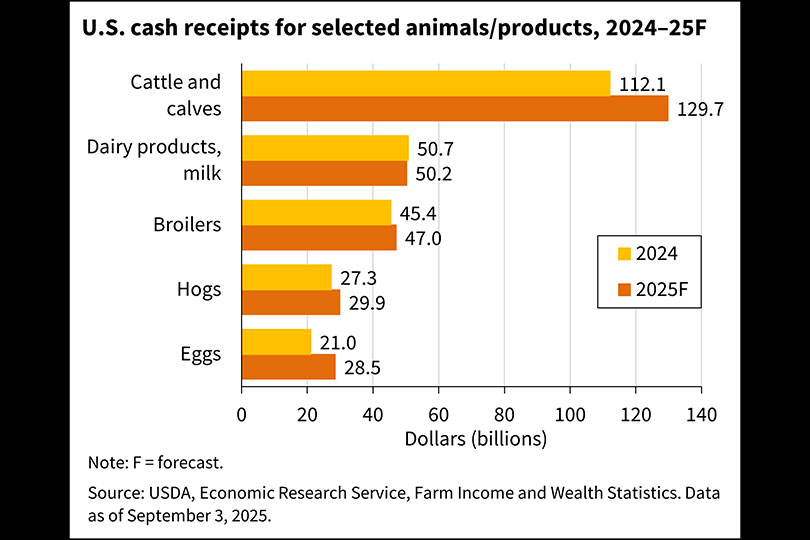

Total animal and animal product cash receipts are forecast at $298.6 billion in 2025, according to USDA.

That’s up 11.2% or $30 billion, not adjusted for inflation, on higher prices.

“Cattle and calf receipts are expected to increase for the fifth year in a row,” Litkowski said.

Cattle and calf receipts are forecast to increase $17.7 billion, or 15.7% due to sustained growth in prices partially offset by lower quantities.

Receipts for eggs are forecast to rise 32%, or almost $7 billion, which would be a record high, if realized.

Hog receipts are forecast to rise 9.5% or $2.6 billion this year, while broiler cash receipts are forecast to rise 3.5% or $1.6 billion.

“Conversely, receipts for dairy are forecast to decrease in 2025 by about 3% or a little under $2 billion,” Litkowski said. “These forecast changes in cash receipts are primarily reflecting expected changes in the prices received by farmers for their commodity production.”

Litkowski said when it comes to livestock, higher prices are expected to increase receipts by nearly $33 billion with only a slight decline due to lower quantities sold in total.

“Higher prices for animal and animal products account for most of the overall increase in total cash receipts in 2025,” Litkowski said.

Crop receipts

Unlike the livestock sector, cash receipts for most crops are expected to be lower this year due to price declines offset only partially by greater quantities for some commodities.

“Receipts for corn, soybeans and wheat are expected to continue to decline in 2025, driving most of the change in total crop cash receipts in 2025,” Litkowski said. “This would be the third year in a row that receipts for each of these commodities has fallen.

Corn receipts are expected to fall 3.7% or $2.3 billion while soybeans are forecast to fall 7.2% or $3.4 billion.

USDA ERS forecasts wheat cash receipts will fall $1.1 billion, or 9.8%, on lower prices and quantity sold.

Rice receipts are forecast to fall 14.8% or $500 million on falling prices and quantities.

Cotton receipts are expected to remain near 2024 levels.

Government payments

Direct government payments administered by USDA and approved by Congress to help farmers and ranchers recover from natural disasters like wildfire and drought helped buoy farm income this year.

“Total direct government payments that are expected to be received in 2025 by farmers is forecast at about $40 billion. That’s an increase of about $30 billion from 2024 levels, and largely this is reflecting increases or expected increases in supplemental and ad hoc disaster assistance,” Litkowski said.

Specifically, that reflects payments that were appropriated in the American Relief Act of 2025.

“That was for economic and disaster assistance for losses that were incurred by farmers in 2023 and 2024. This includes both payments that have already been made in 2025, as well as additional anticipated payments made under programs such as the emergency commodity assistance, emergency livestock relief and supplemental disaster relief programs,” Litkowski said.

Supplemental and ad hoc disaster assistance payments are forecast at $35.2 billion for farmers impacted by natural disasters.

Conservation payments from USDA are forecast at $4.8 billion this year. That’s up $446.3 million, or 10.3%, over 2024. USDA noted the jump is due to an increase in payments from USDA’s Natural Resources Conservation Service.

Farm bill payments, which are a function of commodity prices, are largely unchanged from 2024 at $550.4 million.

USDA loans and insurance indemnity payments are not included in the government payments section of the forecast.

While there is a forecast increase in direct government payments this year, Litkowski noted the numbers remain below the pandemic-level highs in 2020. In fact, government payments fell to $10 billion in 2024, their lowest level since 1982.

Expenses

An expected increase in farm expenditures, like labor, dampens the farm income forecast a bit, per USDA.

“We expect higher expenses in 2025 for labor, livestock and poultry purchases, interest expenses, property taxes and fees, as well as higher net rent in 2025.” Litkowski said. “We also expect that, with some items, spending is going to decrease, or the cost of inputs may fall, like for feed, fertilizer, feeds, pesticides, and fuels and oils.”

Farm sector production expenses are forecast at $467.4 billion in 2025. Adjusted for inflation that’s comparable to 2024.

Not adjusted for inflation, that’s an increase of 2.6% or $12 billion over 2024.

According to USDA, the three largest categories of spending are feed, livestock and poultry and labor.

Feed expenses are forecast at $68.6 billion, down 6.2%, or $4.6 billion, from 2024.

Livestock and poultry costs are expected to rise 21.5%, or $10.6 billion, to $59.9 billion.

“If realized, both livestock and poultry purchases and labor expenses would be at a record high in 2025,” Litkowski said. “Interest expenses, property taxes and net rent are also forecast to increase in 2025.”

Labor costs are forecast 4.2%, or $2.2 billion, higher at $54.3 billion this year as wages increase.

USDA’s farm income forecast is released three times per year. September’s forecast, which also includes data on assets, debt and wealth, is available here.

Leave A Comment