By Emmy Powell

Communications Specialist

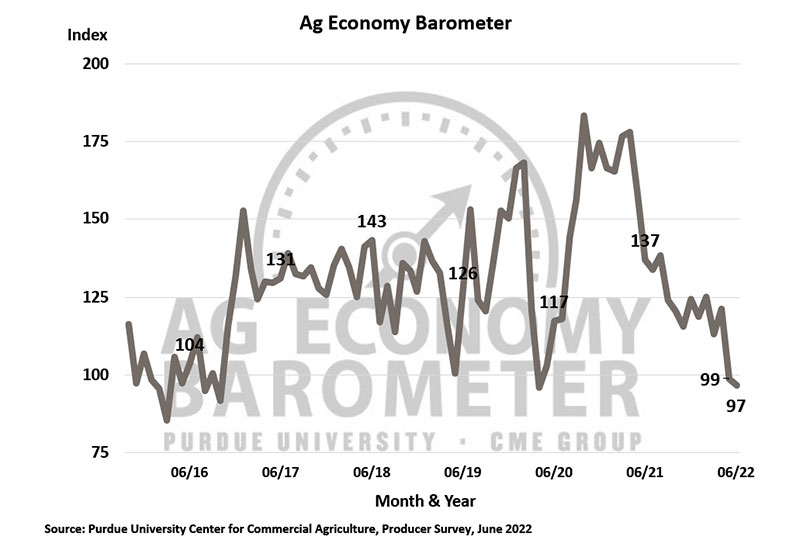

The Purdue/CME Group Ag Economy Barometer showed farmer sentiment remained weak in June, falling two points from May’s reading to a 97.

“Rising input costs and uncertainty about the future continue to weigh on farmer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Many producers remain concerned about the ongoing escalation in production costs, as well as commodity price volatility, which could lead to a production cost/income squeeze in 2023.”

Although farmers were a bit more optimistic about current conditions, they had weaker expectations for the future. The Index of Future Expectations measured at 96, dropping five points below May’s measurement. This is the lowest it has measured since October 2016.

Survey results showed 51% of respondents said they expect their farms to have a worse financial standing in June 2023.

The top concerns for farmers in the upcoming year continue to be:

- input prices (43%)

- input availability (21%)

- government policies (18%)

- and lower output prices (17%).

For the second month in a row, 50% of respondents say that low machinery inventories have had an impact on their plans for purchase.

Looking ahead to 2023, survey data show farmers expect to see another round of significant input costs increases and that inflation will continue to drive up the cost of living.

Short and Long-Term Farmland Value Expectations declined. The short-term index measured nine points below May at 136. The long-term index fell eight points to 141. Both measurements are below the measurements from last fall. Although both recordings are strong, the level of farmers’ confidence has decreased noticeably—the short-term measurement is 13% below, while the long-term is 12%.

Over 52% of respondents expect cash rental rates to rise next year.

And one out of five farmers plan to change their crop mix due to the increases in pricing. Nearly half of the respondents noted the biggest change would be devoting a higher percentage of acreage to soybeans.

The Ag Economy Barometer sentiment index is calculated each month from 400 U.S. farmers’ and ranchers’ responses to a telephone survey.

The survey was conducted from June 13-20.