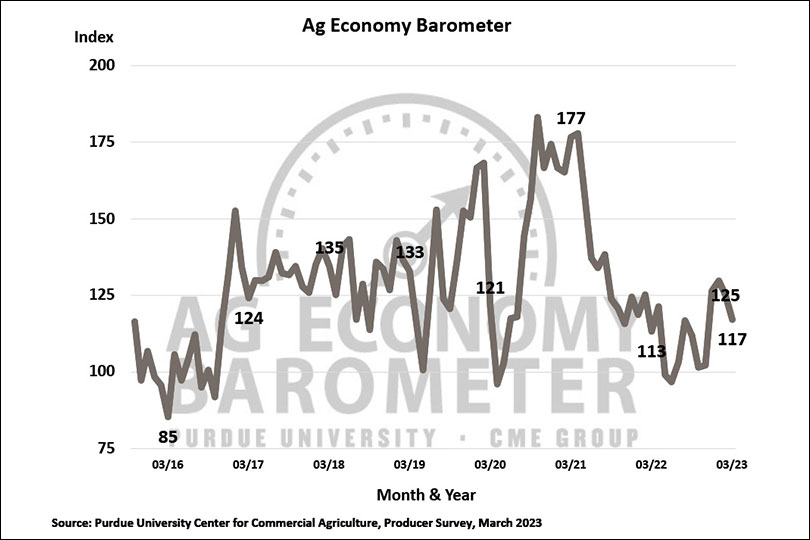

Farmer sentiment fell in March due to weaker prices for some commodities and concerns over interest rates, according to the Purdue University/CME Group Ag Economy Barometer.

The survey of 400 farmers showed sentiment weakened eight points to a reading of 117.

“Rising interest rates and weaker prices for key commodities including wheat, corn and soybeans from mid-February through mid-March were key factors behind this month’s lower sentiment reading,” James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture, said.

The survey was conducted March 13-17, following the downfall of Silicon Valley Bank and Signature Bank.

“Although the March survey did not include any questions directly related to the bank closures, during an open-ended comment question posed at the end of each survey, multiple respondents voiced concerns about the banking sector’s problems and its potential to hurt the economy,” he said. “These problems also likely weighed on producer sentiment.”

The Farm Financial Performance Index remains the same reading as February at 86. Higher input costs were a top concern for 34% of respondents and rising interest rates for 25% of respondents.

Although concern about higher input costs still remains the top concern, the percentage has been falling since last summer’s peak when 53% of respondents cited it as their number one concern for the year ahead. The percentage of farmers and ranchers pointing to interest rates as a top concern has been increasing, up 11 points from last summer.

The Short-Term Farmland Value Index declined six points to 113, which is the weakest reading since September 2020. One out of five producers in the March survey said they expect farmland values to weaken in the next 12 months.

The Long-Term Farmland Value Index rose five points to 142. Long term, 17% of respondents said they expect weaker values in the next five years, up from 13% a year ago and 7% two years ago.

Several renewable energy questions were included in the survey and focused on ethanol and renewable diesel.

While 25% of respondents expect the ethanol industry to grow over the same time period, 46% of respondents said they expected the renewable diesel industry to be larger than it is today.

Respondents were also asked what impact they expect the renewable diesel industry to have on soybean prices over the upcoming five years, with 39% expecting a price increase of up to .50 cents per bushel, 28% expecting a boost in price between 50 cents up to $1 per bushel and 21% expecting soybean prices to rise by $1 or more per bushel.

For more information, visit the Ag Economy Barometer website.

The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey.