By Jennifer Whitlock

Field Editor

China can’t get enough of American beef, according to a July International Agricultural Trade Report by the U.S Department of Agriculture’s Foreign Agricultural Service (FAS).

And the trend is expected to only continue to grow, with FAS noting U.S. sales only accounted for 4% of the market’s share by volume.

“The potential for growth in U.S. beef exports is strong in future years as China import demand is expected to grow more than 30% during the next decade,” FAS analysts wrote.

The agency attributes the drastic rise in Chinese beef imports from the U.S. to the phase one trade agreement implemented in 2020 under then-President Donald Trump. That was a banner year, during which China imported 2.8 million metric tons carcass-weight equivalent (MT CWE) of American beef, worth $10.2 billion.

But in the first five months of 2021, the Asian nation imported a record 1.3 million MT CWE of beef—a 13-fold increase in both exports and sales from the same time last year. Total beef import value so far this year is about $4.6 billion.

Through May 2021, China ranks as the third-largest U.S. market by both volume and value, outpacing Mexico and Canada, which have historically been consistently ranked as top U.S. markets.

Why the dramatic increase?

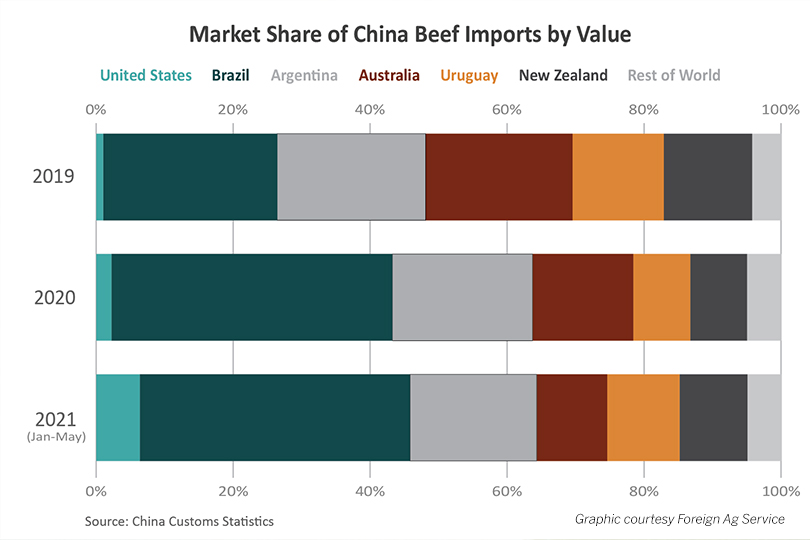

FAS said it’s partly due to reduced competition from Australia, the top U.S. competitor in beef exports. As the nation struggles to rebuild herds after a multi-year drought, Australian beef production remains depressed in 2021.

“China’s imports of Australian beef, which include a grain-fed volume in direct competition with U.S. beef, fell just more than 50% through May 2021,” FAS said. “During that same period, the U.S. has increased its market share [in China].”

A reduction in exports from Argentina may also give U.S. beef sales a boost in China. In May, the Argentinian government issued a temporary 30-day restriction on beef exports to ease food price inflation. Domestically, beef prices in Argentina had risen 60-70% in the previous 12 months, according to a report from Reuters.

On June 22, the government amended restrictions to include only specific muscle cuts through the end of December. But as the fourth-largest exporter in the world and second-largest exporter to China, the Argentinian restrictions allow countries like the U.S. to gain more market share.

Another reason for increased exports to China is American ranchers produce a high-quality product, said Tracy Tomascik, Texas Farm Bureau associate director of Commodity and Regulatory Activities.

“The U.S. is known for producing high-quality, delicious and safe beef. Ranchers across the nation are proud of that recognition, possibly none more so than here in Texas, the top cattle-producing state in the nation,” Tomascik said. “We raise beef cattle using time-honored traditions while incorporating the latest in nutrition, genetics and animal handling to produce a product that is superior. And we do all that while having one of the safest food supply chains in the world. So, it’s no wonder consumers around the globe want more of our beef.”

Organizations and programs like the national and state beef checkoff programs and U.S. Meat Export Federation also contribute to greater demand by increasing knowledge of and exposure to American beef in foreign markets, he noted.

“There is much work being done to promote U.S. beef in China and other nations by these programs, and the results prove their methods are working well,” Tomascik said. “Texas farmers and ranchers look forward to that continued export growth predicted by FAS. They’ll continue raising the animals that go into the global supply chain and ensuring that we keep producing the best beef eating experience around.”

U.S. beef exports are expected to reach a new high of more than 1.5 million tons this year, a 16% increase over 2020 and 8% above 2018’s previous record.

To view this and other FAS beef and cattle reports, click here.