Fertilizer costs remain a major concern as global trade disruptions and higher energy prices fuel fresh volatility for farmers and ranchers working within tight margins.

In a new Market Intel report, American Farm Bureau Federation (AFBF) Economist Faith Parum noted that while prices have not hit the record highs they reached in 2022, some products—like phosphates—are climbing higher.

“Phosphate fertilizers are leading the increase, while nitrogen products are showing month-to-month swings, and potash is rising due to trade policy risks,” Parum wrote.

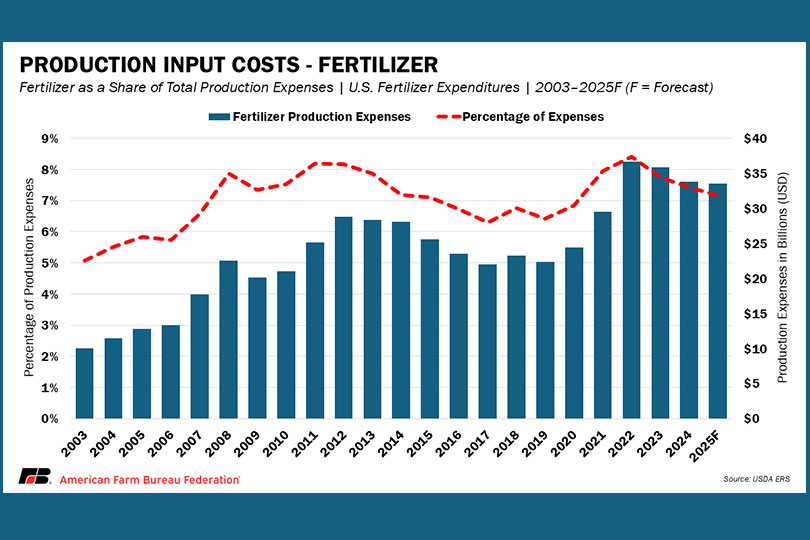

At the same time, Parum said the share of fertilizer within total farm production costs has not returned to earlier highs because other expenses are also climbing. She cited livestock expenses, electricity, cash labor, interest, rent and property taxes among the categories showing notable increases this year, adding to the overall pressure on farm budgets.

Fertilizer prices

Phosphates have had the sharpest price increase this year, with Gulf diammonium phosphate (DAP) prices rising from about $583 per ton in January 2025 to nearly $800 in August.

That’s a 36% increase in less than eight months, creating new strain for already struggling crop budgets, Parum noted.

Monoammonium phosphate (MAP) has followed a similar trend, reflecting the same pressures in production costs and export availability.

Nitrogen markets have been mixed but still volatile. Urea prices rose sharply into the summer before easing modestly. Tampa ammonia settlements reached about $487 per metric ton in August, and some market signals suggest higher prices in September.

Urea Ammonium Nitrate (UAN) solutions have shown regional variation, with tighter supplies in areas farther from production hubs and import terminals, while regions closer to key river or rail transport routes have had more consistent availability. Parum said these swings highlight how quickly nitrogen prices can change in response to global trade and natural gas markets.

Potash prices are also up about 21% higher year-over-year globally, supported in part by U.S. concerns over Canadian imports and related tariff risk.

Volatility ahead

Parum said there are two main factors driving up the cost of fertilizer.

Trade and policy pressures, including export restrictions out of China, new tariffs in the European Union and U.S. tariff action on Canadian potash, are reshaping markets.

“The big drivers are energy costs, mainly because nitrogen fertilizers rely on natural gas and so other countries have had decreased production due to conflict, as well as geopolitical disputes overall,” Parum said.

Impact on farmers

The combination of rising input prices and weaker crop revenues is putting farmers in a difficult spot.

“Seasonal swings in natural gas markets during the winter, coupled with shifting Chinese export policies, are likely to create added price uncertainty in the fourth quarter of 2025 and the first quarter of 2026,” Parum wrote in the Market Intel report. “Markets can change direction quickly, making it difficult for producers to anticipate input costs with certainty.”

The combination of higher expenses and weaker crop revenues is expected to weigh on overall net farm income, particularly for row crop farmers. Fertilizer remains one of the largest and most volatile expenses for crop production, meaning even modest swings in price can alter the outlook for profitability.

“The combined effect of higher expenses and lower revenues is contributing to warnings of stress in the farm economy,” she said. “Even though conditions differ across regions and commodities, the overarching pattern is clear: farmers are entering another year in which volatile markets and tight, or negative, margins reduce their ability to accommodate rising costs.”

Leave A Comment