By Shelby Shank

Field Editor

A recent Market Intel report from the American Farm Bureau Federation (AFBF) underscores a growing reality: most U.S. farm families rely heavily on income earned off the farm to stay afloat.

In 2023, just 23% of farm household income came from farming. The other 77% came from outside sources like wages, investments, pensions or small non-farm businesses.

“Income from these off-farm roles is what keeps the operation running,” AFBF Economist Daniel Munch wrote in the report.

According to the U.S. Department of Agriculture (USDA), 96% of farm households earned some kind of off-farm income in 2023.

This stems in part from USDA’s broad definition of a farm, which includes any operation with over $1,000 in ag product sales. That low threshold captures many small-scale or lifestyle farms that aren’t intended to generate full-time income.

“Still, the difference highlights the vital role off-farm income plays in keeping many farm households financially afloat,” Munch said.

Off-farm income peaked in 2021 at over $82,800 and has since declined only slightly.

Off-farm income falls into two broad categories: earned, which requires work or time, and unearned, which comes from passive sources or public transfers.

About 72% of off-farm income in recent years comes from earned sources like wages or salaries, often from jobs in healthcare, education or retail. The remaining 28% comes from passive income such as Social Security, pensions or investment returns. These smaller streams can be especially helpful for older or semi-retired farmers no longer relying on wages.

The smaller the farm, in terms of gross cash farm income, the more likely the farmer works off the farm.

Among farms making less than $100,000 in annual gross sales, over 60% of farmers had an off-farm job. For farms with more than $500,000 in gross sales, that number drops to below 45%. Smaller farms often can’t cover living expenses or business costs on farm income alone, so outside work helps bridge the gap, Munch said.

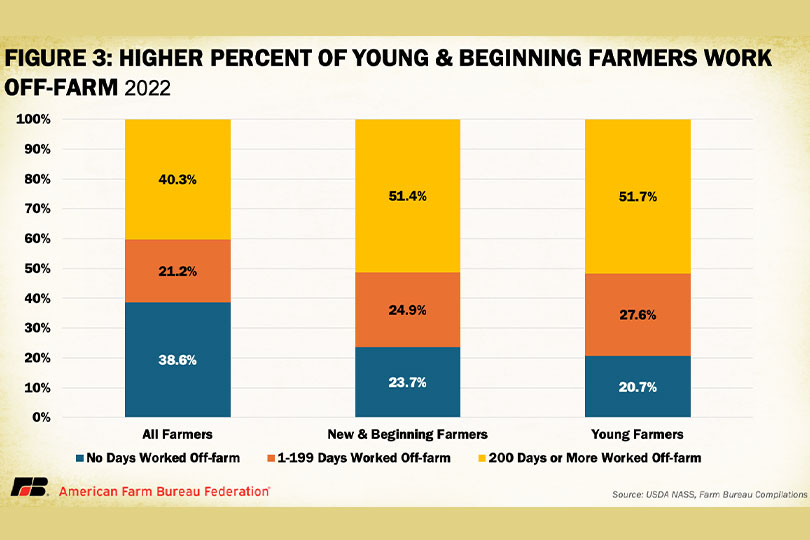

Young and beginning farmers are also more likely to work off the farm. Without inherited land, equipment or equity, it’s difficult to rely solely on early farm earnings. They often depend on off-farm jobs to make ends meet, build credit and gain benefits like health insurance.

Data shows that only about 20% of young farmers and 24% of beginning farmers reported working exclusively on the farm compared to nearly 40% of all farmers.

The type of farm also plays a role. Dairy farmers rely most heavily on income from the farm since their work is labor-intensive and year-round. In 2023, dairy household earned 81% of their income from the farm.

In contrast, cattle operations, which are often more flexible or part-time, earned just 10% and other field crop farms earned only 9% of income from the farm.

Farmers say they take off-farm jobs for many reasons, but a 2018 USDA survey identifies the main reasons as more stable income, better pay and access to health insurance or retirement plans. These financial pressures are especially strong when farm prices drop or income falls short.

“These motivations speak to both the unpredictability of farm income and the need for household stability,” he said.

This shift in how farm families earn their income also reflects larger changes in rural America. With fewer local jobs available due to a decline in local ag and manufacturing jobs, many family members commute long distances for work.

As production becomes more efficient and standardized, and as commodities move quickly through global markets, there’s often less opportunity to differentiate what one farm produces from another.

“This often leaves price as the primary factor driving a buyer’s decision to purchase an agricultural product,” Munch said. “With tighter margins and fewer ways to stand out, financial risk grows.”

The off-farm income serves as a form of diversification and helps farm families spread risk.

“Without access to reliable off-farm jobs, which increasingly require commuting beyond one’s own county, many farm households can struggle to stay afloat. And even large-scale operations rely on vibrant communities for schools, clinics and essential services that support family life,” Munch said in the report. “In the end, supporting agriculture isn’t just about what happens on the farm. It’s about the broader environment that makes farming possible.”

For more on the off-farm income report, visit fb.org/market-intel.

Leave A Comment