Federal mandates hurt the cattle industry

The Cattle Price Discovery and Transparency Act would impose federal mandates on the cattle market. Texas Farm Bureau (TFB) and American Farm Bureau Federation (AFBF) oppose this legislation because it takes away ranchers’ freedom to market cattle as they see fit. No studies or supporting evidence have proven a government mandate in the cattle market will increase the price of cattle. Economists at top universities have provided extensive analysis proving the mandate would have a negative effect on cattle markets with a decrease in the price per head of cattle. It is critical to oppose this legislation.

AFBF policy specifically states in Section 310/Livestock Marketing: 4.2 that:

We oppose government mandates that force any livestock slaughter facility to purchase a set percentage of their live animal supply via cash bids.

The AFBF board of directors voted on the following policy position regarding the Cattle Price Discovery and Transparency Act:

“The American Farm Bureau Federation (AFBF) will continue to stay engaged in the Cattle Price Discovery and Transparency Act, but with strong opposition to the provision on mandatory minimum negotiated trade.”

TFB is committed to working toward solutions to increase transparency and price discovery for cattle ranchers. However, it is important to ensure legislation is well thought out before being enacted. Failure to do so can hurt the very producers it is intended to help.

Impact of Government Mandating Cash Trade of Cattle

Extensive reports on the U.S. cattle market, including information on supply chain disruptions, do not point to mandating cash trade as a successful solution. Below are links to the published reports.

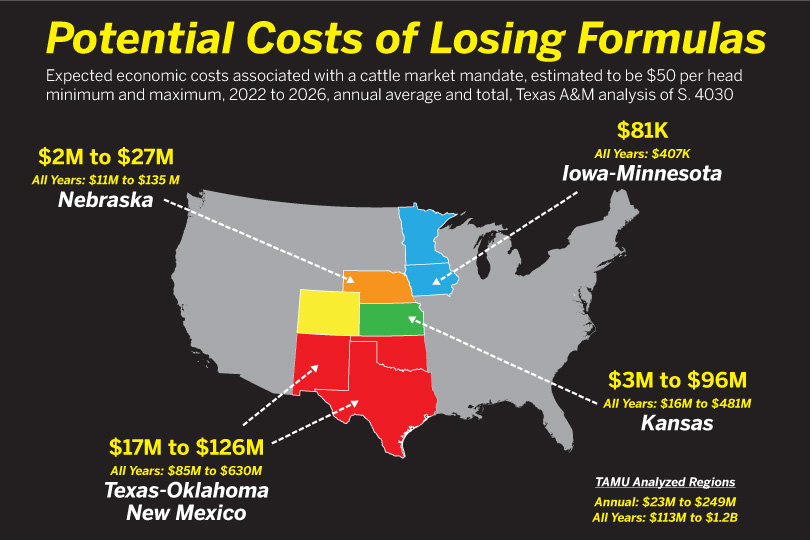

Mandated cash trade would cost ranchers between $23 – $249 million annually depending on where the secretary of agriculture sets the mandate during the five years, according to data analyzed by the Agricultural and Food Policy Center. About 90% of the total costs will be shared by Texas, Kansas, Oklahoma and New Mexico cattle producers.

The Texas region losses will range from $17 – $126 million annually.

The Cattle Markets Working Group consisted of 10 state Farm Bureau presidents—Arizona, Iowa, Kansas, Kentucky, Mississippi, Montana, Nebraska, New York and Texas, as well as AFBF Vice President from South Dakota.

“Additional regulation may not solve the problems as intended and could potentially result in negative consequences. A key point to remember when discussing the optimal level of negotiated transactions is that price discovery is not the same as price determination. While enhanced price discovery is a good thing, it does not necessarily mean it will result in higher prices (as many proponents of minimum thresholds contend). Mandatory minimum negotiated trade could potentially inhibit a producer’s ability to enter into AMAs, which are typically a premium paid above market value.”

View the report.

The Livestock Working Group consisted of representatives from the following state Farm Bureaus: Indiana, Kansas, Mississippi, Montana, Pennsylvania and Texas.

“Government-mandated cash purchases will not cause an increase in cattle prices and price discovery is not the same as price determination.”

View the report.

Published by seven Extension, agribusiness and livestock marketing experts.

“There is no research evidence of any significant or persistent fed cattle price discovery problem at this time. This legislation is attempting to solve a problem that does not exist. As such, this legislation offers zero benefits for fed cattle markets and imposes many millions of dollars of additional cost, added risk, and lost value. The exact cost will depend on details of implementation, but the cost is minimally hundreds of millions of dollars resulting in lower feeder cattle prices and higher consumer beef prices.”

View the comments.

Published by economists at the Agricultural and Food Policy Center.

“Negotiated trade mandates do provide additional price discovery and market transparency. More price discovery, however, does not mean that cattle prices would be higher. It’s worth explicitly pointing out the economic tradeoffs that this portion of S. 3229 creates. The bill does increase price discovery, but at the cost of lower prices to cattle producers and higher prices to beef consumers. There is no evidence that increasing price discovery would increase cattle prices.”

View the report.

The Agricultural and Food Policy Center published this report at the request of the U.S. House Committee on Agriculture in 2020.

“Thus, a potential outcome is that policies aimed at increasing negotiated cash trades and thereby reducing AMAs may have the unintended consequence of reducing overall economic surpluses currently achieved in the fed cattle and beef sector.”

View the report.

Published by Stephen R. Koontz; Department of Agricultural & Resource Economics at Colorado State University

“Mandating levels of negotiated cash trade would not have changed the supply/demand imbalance and the market impacts on prices, and packer margins, in the 2020‐21 period. Mandates nor improved price discovery would change that there were more cattle than could be slaughtered, fabricated, and further processed.”

View the report.

Published by Stephen R. Koontz; Department of Agricultural & Resource Economics at Colorado State University

“Formulas are alternatives to the cash market that are innovations and improvements that have benefited the entire industry—and not without cost but costs appear minimal. Risks associated rejecting these innovations appear substantial. In short, the potential costs of mandates are many and high while the benefits are few and negligible. The benefits are also likely not achievable—or enforceable—without tremendous change. An objective assessment of mandates results in a rather one‐sided conclusion. This is a conclusion drawn when an assessment of existing research undertaken, when a position is established based on facts and science, and when viewed based on economics of cattle and beef markets.”

View the report.

Published John D. Anderson, James L. Mitchell and Andrew M. McKenzie – University of Arkansas System Division of Agriculture.

“The decline in value from the loss of AMAs over the five-year period ending with 2020 would have averaged about $6 million per year for the state of Arkansas.”

“Increasing negotiated fed cattle trade by 1% is associated with a $1.712 million per year decline in Arkansas feeder cattle value. Combined the effect is about a $4 million decline in the value of Arkansas cattle.”

View the report.

Where the bill stands

The Cattle Price Discovery and Transparency Act (CPDTA) has been reintroduced in the U.S. House and Senate for the 118th Congress. In 2022, there were attempts to pass the legislation. However, the bill failed to receive enough support to move forward in either chamber. It is crucial to tell your Congressmen and Senators to oppose the bill as long as the mandate portion is included.