The U.S. Department of Agriculture (USDA) updated the Coronavirus Food Assistance Program (CFAP) to provide relief to more farmers and ranchers.

The new CFAP 2.1 includes expanded eligibility for certain commodities and farmers established in the recently passed relief package. The expansion includes contract growers of broilers and hogs.

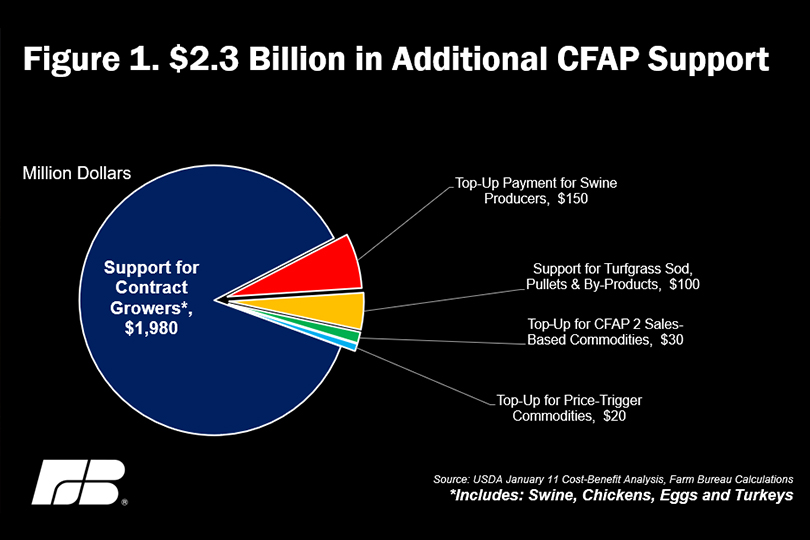

“The biggest one is going to be contract broiler producers, as well as contract hog producers,” American Farm Bureau Federation (AFBF) Economist Michael Nepveux said. “These folks were left out of the original, because there was a provision that required ownership of the commodity. Because of the nature of raising an animal under contract for somebody else, they happened to be left out of that. They also specified things like turf grass sod, as well as included some additional top-up payments for swine producers.”

Farmers have until Feb. 26 to submit new applications or modify existing applications if they have participated in the program already.

Updated Payment Calculations for CFAP 2 and CFAP 1

Along with the additional assistance, the Farm Service Agency adjusted the payment calculation to use the 2019 calendar year sales and 2019 crop insurance indemnities, Noninsured Crop Disaster Assistance Program and Wildfire and Hurricane Indemnity-Plus payments, multiplied by the applicable payment rate for sales commodities.

In the CFAP 2 program, the sales commodities included specialty crops, aquaculture, tobacco, specialty livestock, nursery crops and floriculture.

FSA also adjusted the CFAP 2 payment calculation for certain row crops, addressing an issue that existed for farmers who had crop insurance coverage but did not have a 2020 Actual Production History (APH)-approved yield. Now, when APH is not available, FSA will use 100 percent of the 2019 Agriculture Risk Coverage-County benchmark yield to calculate payments instead of the 85 percent the earlier CFAP 2 calculations required. This change only covers farmers with crop insurance coverage who grow barley, corn, sorghum, soybeans, sunflowers, upland cotton and wheat.

Swine producers who participated in CFAP 1 will be receiving an automatic “top-up” payment of $17 per head, increasing the total CFAP 1 inventory payment to $34 per head. Payment rates for swine are increasing from 25 percent to 50 percent of the estimated total economic loss. This top-up payment aims to rectify large differences between first quarter sales loss rates and inventory payment rates for CFAP 1 payments, which were based on expected sales in the second and third quarters. There is no action required by producers to receive these additional payments. Producers who did not submit an approved CFAP 1 application are not eligible.

Newly Eligible Commodities and Producers

Many producers were left out of the CARES Act and subsequent CFAP programs because farmers who raise animals under a contract for another entity that owns the animals could not participate. Poultry, in particular, was left out of the CARES Act, largely due to the structure of the industry and how the relationship between the farmer and integrator operates.

Typically, a broiler farmer raises and cares for the birds, but the integrator maintains ownership of them. However, these farmers saw their income significantly reduced as many of their barns, which they financed the construction of and still were required to service the debt on, remained empty due to supply chain disruptions earlier in the pandemic.

The impacts to contract growers could arise from a variety of conditions, including: delayed delivery of young poultry and hogs to contract producers, decreased housing densities, additional costs for keeping animals longer than typical durations and damage caused by animals too large for housing.

USDA clarified that contract farmers of broilers, turkeys, chicken eggs, laying hens and hogs who suffered a drop in revenue in 2020 due to the pandemic are now eligible for assistance.

Payments are based on eligible revenue for Jan. 1, 2020, through Dec. 27, 2020, minus eligible revenue for Jan. 1, 2019, through Dec. 27, 2019, multiplied by up to 80 percent, subject to availability of funds.

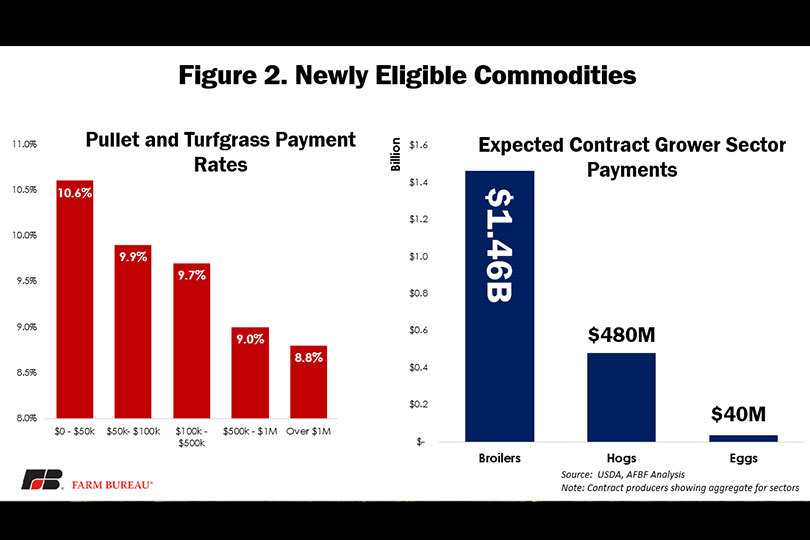

Farmers of pullets and turfgrass sod are also now eligible for CFAP payments. These commodities were not explicitly included in the original CFAP 2 rule, but their payment structure will be similar to sales commodities. The payment rate will vary based on their overall sales. For example, if we look at Figure 2, a pullet farmer with less than $50,000 in sales would receive a payment rate of 10.6 percent of those total sales. Figure 2 also shows the expected total payments to each sector of contract growers as calculated in USDA’s cost-benefit analysis of the rule. While the analysis does not show any payments for turkeys, this does not mean that farmers are ineligible. In this analysis, USDA is examining the industries in aggregate, and as a result, estimates the aggregate industries’ revenue did not suffer a loss. Individual farmers who can show that they suffered a decline in revenue from 2019 to 2020 are eligible and should apply for the program.

Of the $2.3 billion in additional CFAP support, USDA’s cost-benefit analysis estimates that contract poultry farmers will receive about $1.5 billion in CFAP support. Following poultry, contract hog farmers are expected to receive $479 million, and top-up inventory payments for swine farmers are expected to total $150 million. Combined, contract poultry, contract hog and swine inventory payments are expected to total nearly $2.1 billion, about 91 percent of these new additional resources.

How to Apply

Newly eligible farmers who need to submit a CFAP 2 application or farmers who need to modify an existing one can do so between Jan. 19 and Feb. 26, 2021. Farmers who are modifying their applications should contact their local USDA Service Center for assistance. Farmers who are filing new applications should contact their Service Center or call 877.508.8364 for one-on-one support.

Additional information can be found on USDA’s CFAP website.