By Jennifer Dorsett

Field Editor

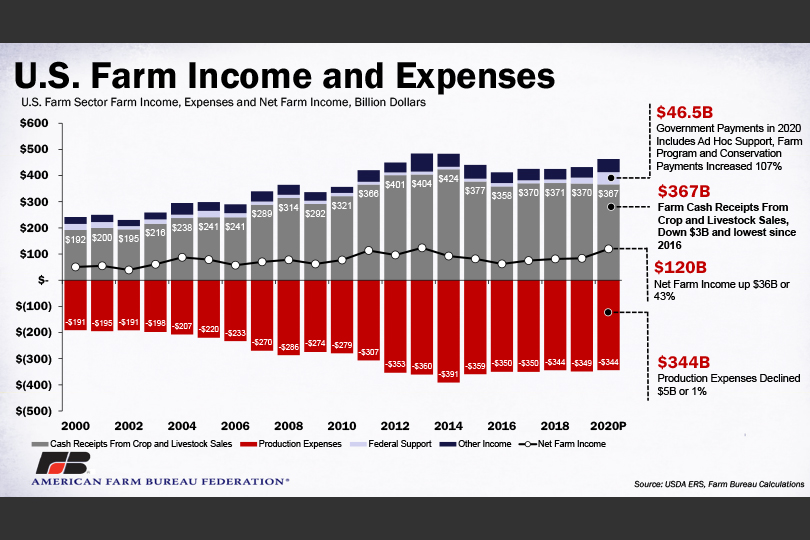

A revised outlook of farm financial indicators released in December estimates a rise in net farm income for 2020. Those increased projections are due in part to government payments and improved commodity prices.

The U.S. Department of Agriculture’s (USDA) Economic Research Service (ERS) released the December edition of the 2020 Farm Sector Income Forecast, projecting net farm income will rise to $119.6 billion in 2020, increasing for the fourth consecutive year.

But is this increase a false positive?

John Newton, American Farm Bureau Federation (AFBF) chief economist, believes 2020 farm income is an anomaly due to the large increase in government assistance and relief received by farmers and ranchers this year.

Although net farm income may have risen in 2020, Newton said farm cash receipts, or what farmers receive from sales of their products, were actually down this year to the lowest level since 2016.

“There were sharp price drops across several major commodities—dairy, cattle, wheat, corn and soybeans. All saw prices fall when the COVID-19 pandemic first hit,” he said. “But there was a late season upturn in some commodities, like soybeans, due to some big purchases from China, so prices have gone up in some cases since then. So, we are likely to see somewhat better commodity prices in 2021.”

But Newton expects farm profitability will likely fall in 2021 due to the loss of ad hoc government support. Nearly $46.5 billion, or about 35 percent of 2020 farm income, came in the form of assistance such as the USDA’s Coronavirus Food Assistance Program (CFAP) or Market Facilitation Program (MFP).

To put that into perspective, government payments averaged less than $12 billion a year from 2015 through 2017.

Despite the vaccine announcement, a spike in COVID-19 cases across the nation into the winter dampened some signs of economic recovery seen in early fall 2020.

“Gasoline demand dropped 15 percent the first week of December,” Newton said. “Of course, that will affect Texas’ overall economy because of the oil sector, and because of ethanol consumption, that affects corn prices on a national level.”

Texas farmers and ranchers, like others across the nation, face the new year with some optimism and a big dash of uncertainty. Newton said there are no guarantees 2021 will be a good year, but there are signs of hope on the horizon.

“We’ll just have to wait and see what the impact of this third wave of COVID-19 brings,” he said. “If the economy rebounds, prices for things like beef should rebound, too. And cotton prices have improved. China has been buying more cotton, so that should help bring those prices back up some. Demand remains strong for our agricultural products, but COVID spikes can keep that demand suppressed for some time.”

AFBF economists further evaluate USDA’s farm income report online at fb.org/market-intel.

AFBF economists noted several factors could impact the farm economy in 2021.

Export commitments are record high, but the cancellation of outstanding sales is possible. This would lower exports, boost inventory levels and put downward pressure on U.S. prices.

Additional COVID-19 lockdowns could once again create farm price volatility like it did last spring.

USDA’s first projection for 2021 farm income and expenses will be released in February.

“One thing is certain, net farm income (profitability) in 2021 will be lower. Without additional financial support of some sort, federal assistance in the form of traditional farm program and conservation program payments are likely to return to historic levels of $10 billion to $12 billion,” AFBF economists said.